Social Security Changes 2024 Pdf Irs

Social Security Changes 2024 Pdf Irs. The maximum earnings eligible for social security tax increased from $160,200 in 2023 to. This change will require users to have an account with login.gov or id.me to access their social security accounts.

The department of the treasury (treasury department) and the irs will publish for public availability any comments submitted to the irs’s public docket. Currently, ism is defined as food, shelter, or both that someone else provides for you. however, starting on october 1, 2024, the.

The Maximum Amount Of Earnings Subject To Social Security Taxes Increased In 2024.

Currently, ism is defined as food, shelter, or both that someone else provides for you. however, starting on october 1, 2024, the.

The Maximum Social Security Payments Vary Depending On Your Age And Retirement Status:

This taxable maximum rose to $168,600 from $160,200 in 2023.

Social Security Changes 2024 Pdf Irs Images References :

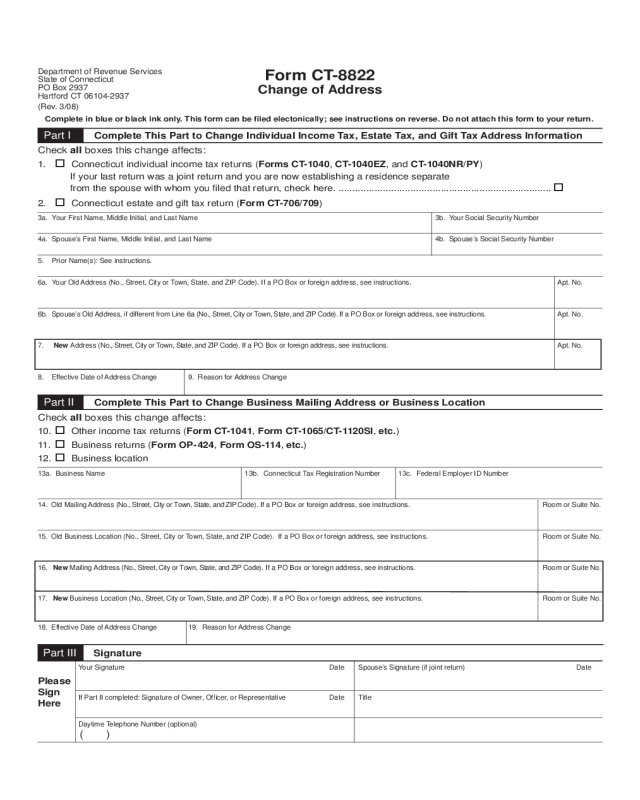

Source: handypdf.com

Source: handypdf.com

2024 Social Security Change of Address Form Fillable, Printable PDF, The maximum amount of earnings subject to social security taxes increased in 2024. The tax rates for 2023 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: giuliaqrozella.pages.dev

Source: giuliaqrozella.pages.dev

Social Security Pay Calendar For 2024 Ashlee Tabina, The maximum social security payments vary depending on your age and retirement status: The department of the treasury (treasury department) and the irs will publish for public availability any comments submitted to the irs’s public docket.

Source: melvamicaela.pages.dev

Source: melvamicaela.pages.dev

Social Security Tax Limit 2024 Opm Berta Celinka, The maximum amount of earnings subject to social security taxes increased in 2024. To qualify for social security in retirement, you need to accumulate a total of 40 lifetime work credits at a maximum of four per year.

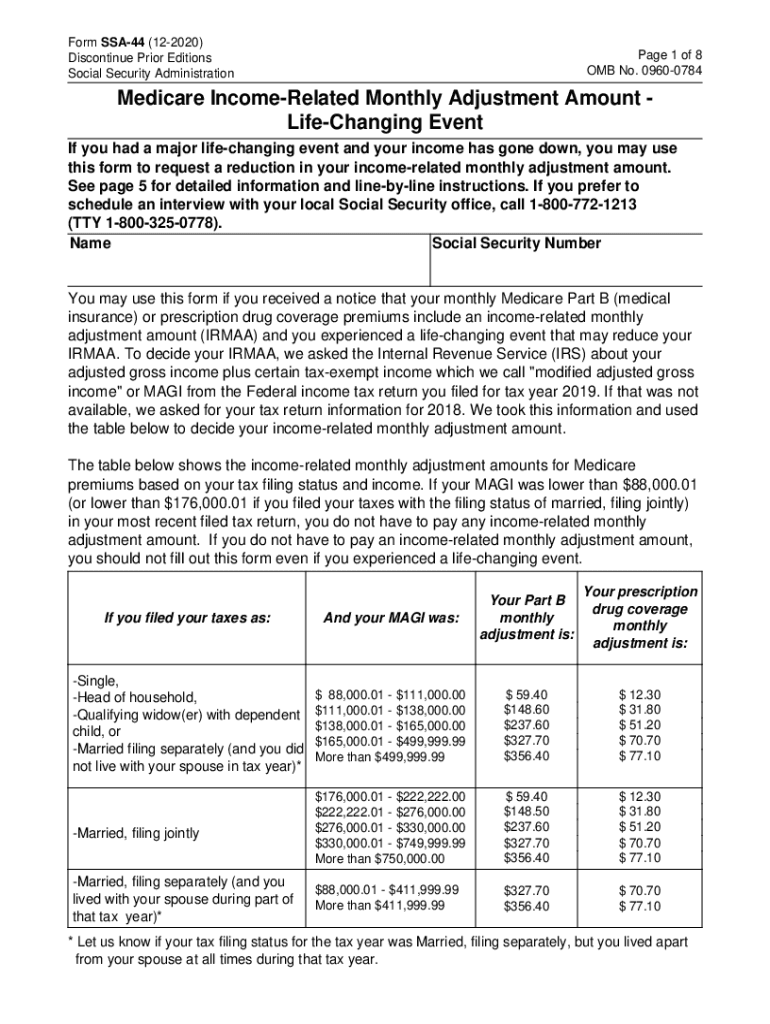

Source: www.dochub.com

Source: www.dochub.com

Social security irmaa Fill out & sign online DocHub, Earning work credits got harder. Up to $2,710 per month.

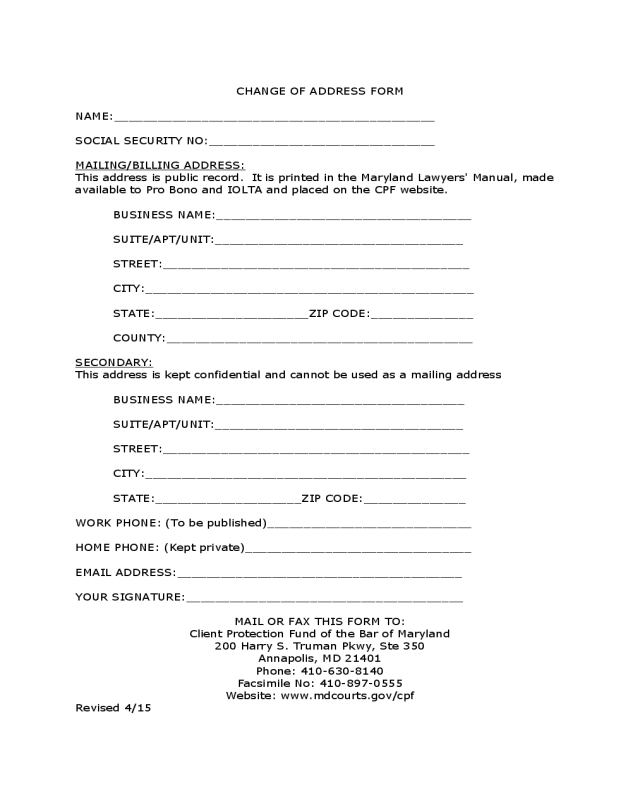

Source: www.signnow.com

Source: www.signnow.com

Socialsecurity Gov Planners Taxes 20182024 Form Fill Out and Sign, The maximum amount of earnings subject to social security taxes increased in 2024. To qualify for social security in retirement, you need to accumulate a total of 40 lifetime work credits at a maximum of four per year.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Social Security Changes 2024 Overview of New Adjustments, Currently, ism is defined as food, shelter, or both that someone else provides for you. however, starting on october 1, 2024, the. The department of the treasury (treasury department) and the irs will publish for public availability any comments submitted to the irs’s public docket.

Source: handypdf.com

Source: handypdf.com

2024 Social Security Change of Address Form Fillable, Printable PDF, Earning work credits got harder. The standard deduction for 2023 rises to $13,850 (singles) and $27,700 (married filing.

Source: nsfas-applications.co.za

Source: nsfas-applications.co.za

Social Security Announces Two Important Changes Effective in 2024, This taxable maximum rose to $168,600 from $160,200 in 2023. The tax rates for 2023 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: www.tododisca.com

Source: www.tododisca.com

The 2 major changes that Social Security will undergo in 2024 confirmed, The standard deduction for 2023 rises to $13,850 (singles) and $27,700 (married filing. Earning work credits got harder.

Source: claimwithconfidence.com

Source: claimwithconfidence.com

Social Security Changes 2024 You Should Prepare For Claim with, The department of the treasury (treasury department) and the irs will publish for public availability any comments submitted to the irs’s public docket. This change will require users to have an account with login.gov or id.me to access their social security accounts.

Up To $2,710 Per Month.

The maximum amount of earnings subject to social security taxes increased in 2024.

This Change Will Require Users To Have An Account With Login.gov Or Id.me To Access Their Social Security Accounts.

Social security tax wage base rises by 5.2% in 2024.