403b Max Contribution 2024 Catch Up Date

403b Max Contribution 2024 Catch Up Date. The maximum 403(b) contribution for 2024 is $23,000. 457 b max contribution 2024 date.

403(b) irs contribution limits for 2024. For 2023, employees could contribute up to $22,500 to a 403 (b) plan.

403b Max Contribution 2024 Catch Up Date Images References :

Source: daisiblyndsay.pages.dev

Source: daisiblyndsay.pages.dev

Maximum 403b Contribution 2024 Joana Lyndell, The first one is the cap on elective salary deferrals, meaning the portion of salary that an employee decides to put directly into the 403(b) account.

Source: hindablynelle.pages.dev

Source: hindablynelle.pages.dev

Max Roth Ira Catch Up Contribution 2024 Tally Felicity, The 2024 403 (b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions.

Source: daisiblyndsay.pages.dev

Source: daisiblyndsay.pages.dev

Maximum 403b Contribution 2024 Joana Lyndell, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2024 is $23,000, up $500 from 2023.

Source: kariaqlanette.pages.dev

Source: kariaqlanette.pages.dev

What Is The Max 403b Contribution For 2024 Jenny Cristine, 401k max contribution 2024 catch up date.

Source: jankaqroxanne.pages.dev

Source: jankaqroxanne.pages.dev

403b Catch Up Contribution Limits 2024 Birgit Fredelia, A 403 (b) plan is a retirement plan maintained by a 501 (c) (3) organization, minister, or.

Source: nicholasbrown.pages.dev

Source: nicholasbrown.pages.dev

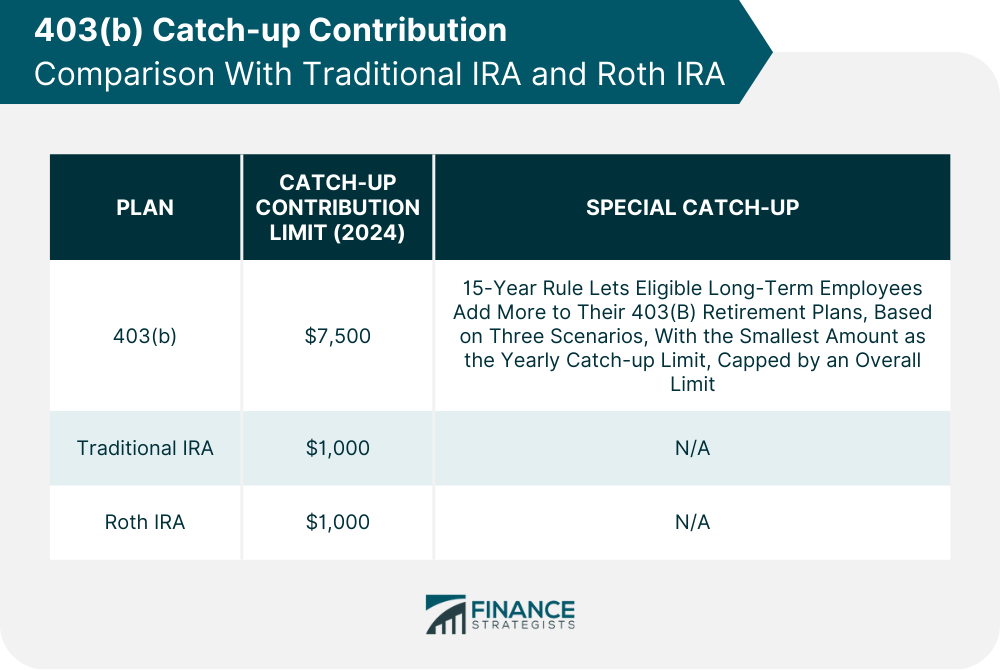

Max 403b Contribution 2024 Catch Up Nicholas Brown, If you're 50 or older, you can contribute an.

Source: jankaqroxanne.pages.dev

Source: jankaqroxanne.pages.dev

403b Catch Up Contribution Limits 2024 Birgit Fredelia, 457 b max contribution 2024 date.

Source: deenabmikaela.pages.dev

Source: deenabmikaela.pages.dev

Max 403b Contribution 2024 Catch Up Camala Estella, A 403 (b) plan is a retirement plan maintained by a 501 (c) (3) organization, minister, or.

Source: seanamarissa.pages.dev

Source: seanamarissa.pages.dev

403b Max Contribution 2024 Ilyse Leeanne, On your end, you can defer up to $23,000 from your salary to your 403 (b) in 2024.

Source: www.youtube.com

Source: www.youtube.com

What is a 403b catchup contribution? YouTube, If you're 50 or older, you can contribute an.

Posted in 2024